Business expenses managed effortlessly

Experience the next generation of expense management with a solution capable of managing any type of business expense.

Integrate with your existing accounting solution:

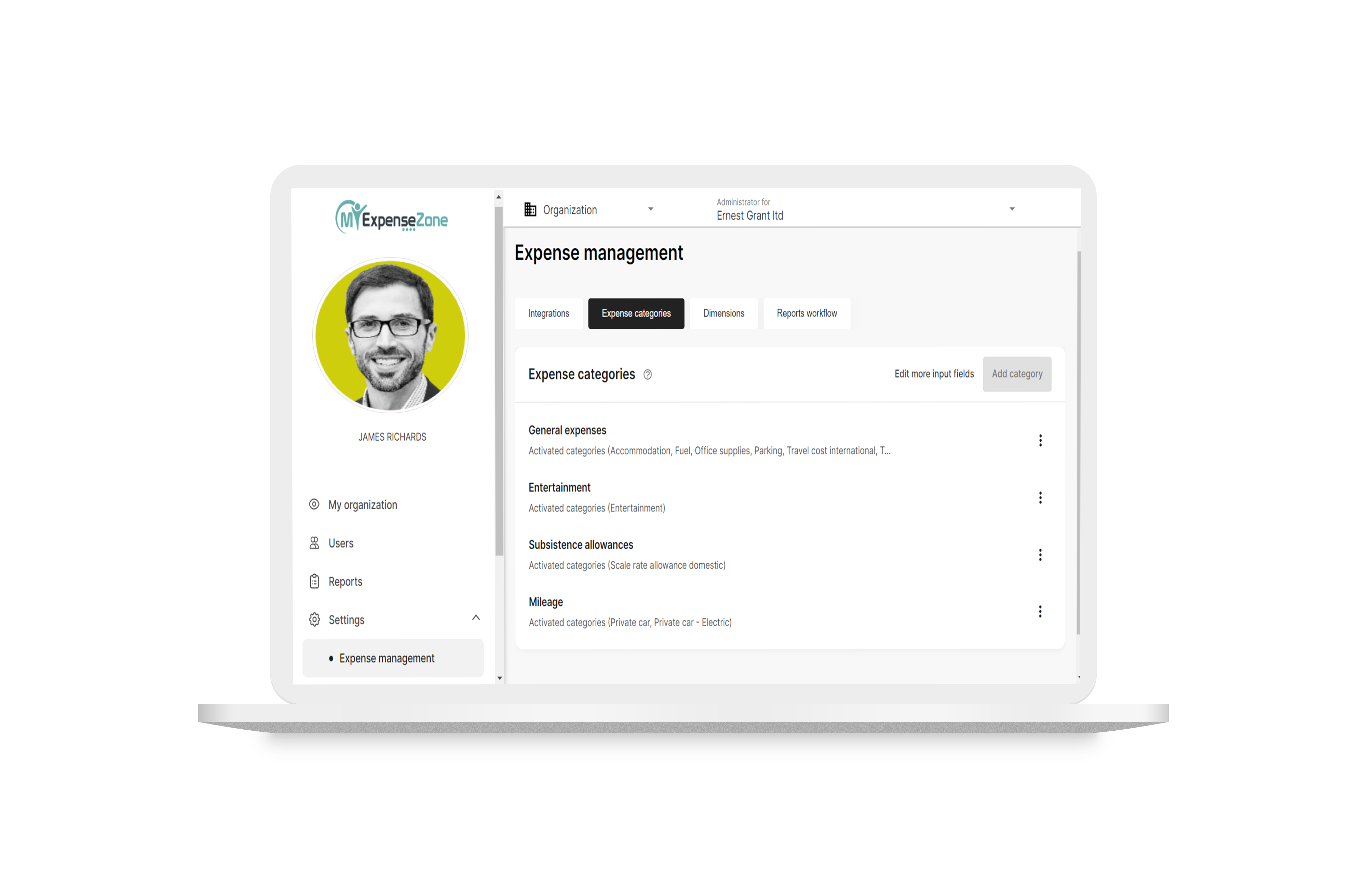

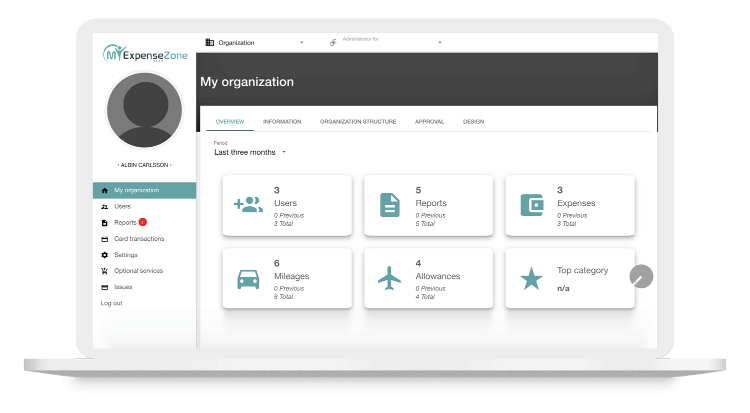

Business expense management built with you in mind

MyExpenseZone works seamlessly, regardless of which cards or accounting and payroll systems you use. With agile report editing build-in there will be no more sending reports back and forth to colleagues.

Optimised for everyone in your organisation, from the employee who reports the expense, to the manager who approves expenses and finally the finance department that manages the accounting and reimbursement process.

As your company grows MyExpenseZone will grow with you, allowing you to add additional users at any time, and if you have several companies, our solution can handle this in a simple way.

Discover a smarter way to manage business expenses and company spending

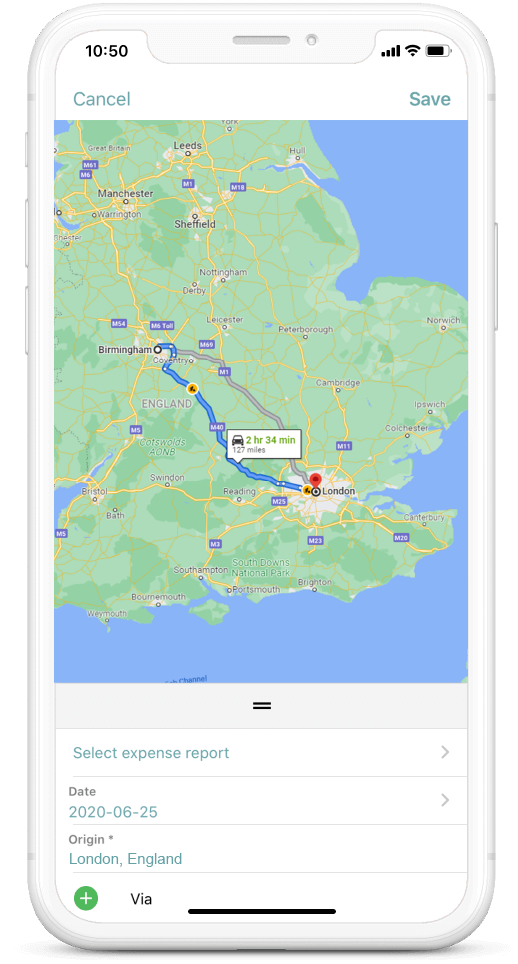

Easy mileage expense management

Smarter mileage tracking

No more manual input, replace 20th century driving logos with a digital solution. Trips are imported directly into MyExpenseZone.

Digitise your mileage tracking

With digital and automatic solution, there’s no more manual input meaning you can get rid of obsolete paper-based logs and templates. Your employees will become more productive in their everyday lives.

Never forget to report another trip

No risk of every forgetting to report another trip because our app keeps track of trips and congestion charges for you. What’s more, you’ll comply with local Tax Agency’s requirements for business trip reporting.

Everything in one place

With MyExpenseZone and mileage tracking, you get all travel and business expenses, per diem allowances and mileage in one location. One app, one expense report, one approver.

1.

Reading the mileage

The GPS receiver in your car automatically detects when you start and finish your journey.

2.

Information transfer

The mileage tracker saves the trip’s date, time and mileage and automatically transfers the information to MyExpenseZone.

3.

Reporting

Using MyExpenseZone, you can easily choose which trips to report and then submit for approval.

4.

Approval

A completed and correct expense report is sent through to the finance department for reimbursement.

UK Approved rate

Mileage Allowance Payments (MAPs) are what you pay your employee for using their own vehicle for business journeys.

Your allowed to pay your employee a certain amount of MAPs each year without having to report them to HMRC, this is called an ‘approved amount’. If you reimburse employees above the approved amount, the benefit-in-kind will need to be reported to HMRC to deduct any further tax due.

MyExpenseZone records the approved rates and you can generate reports, which shows how much you’ve paid to staff above or below approved rates. This determines by simply multiplying the employees travel miles for the year by the rate per milefor the vehicle. The total includes any type of vehicle they’ve used. The rates below were correct in 2020.

Anything below the ‘approved amount’ then you wont have to report to HMRC or pay tax, but your employee will be able to get tax relief Mileage Allowance Releif, or MAR) on the unused balance of the approved amount. You can make separate optional reports to HMRC of any such unused balances under a scheme called the Mileage Allowance Relief Optional Reporting Scheme (MARORS)

Approved Rates

| Vehicle | 10,000 miles | > 10,000 miles |

| Cars & vans | 45p | 25p |

| Motorcycles | 24p | 24p |

| Bikes | 20p | 20p |

Advisory Electric Rate (AER) is 4 pence per mile.

Example Cumulative Mileage and Tax

An employee travels 12,000 business miles in their own car for a given tax year. The vehicle is petrol and over 2000cc with an advisory rate of 21p.

Approved amount: (10,000 x 45p) + (2,000 x 25p) = £5,000

Tax on fuel: (12,000 x 21p) / 6 = £420. Fuel is divided by 6 as includes tax at 20% i.e. (20/120=6)

The invoice claim value would be: Net: £4,580 Tax: £420 Gross: £5,000

Example personal and company vehicle

The advisory fuel rate for a petrol car over 2000c is currently 21p per mile and an employee travels a distance of 100 miles. The fuel amount would be £21.00 which is inclusive of Tax and is the equivalent of 120%, the Tax element is calculated by dividing the amount by 6, being £3.50.

Expense mileage reclaim in personal car:

| (45p x 100) | = £45.00 |

| (21p x 100) /6 | = £3.50 |

Net: £41.50 Tax: £3.50 Gross: £45.00

Expense mileage reclaim in a company car:

| (21p x 100) | = £21.00 |

| (21p x 100) / 6 | = 3.50 |

Net: £17.50 Tax: £3.50 Gross: £21.00

Your business is treated as a fuel purchase of £21.00 (inclusive of Tax) with your Tax bill being reduced by £3.50.

You must keep fuel receipts to support Tax reclaim. In the first example, you need fuel receipts of at least £5,000 to support the claim for £420, the second example at least £21 to support a tax claim of £3.50.